Services

- In House Broker

- Bonded Warehouse (G.O.,Warehouse Entry & FTZ)

- Fright Forwarding

- Logistics

- Distribution Service

Forms and Descriptions

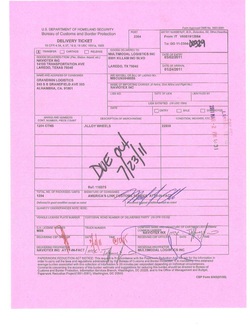

- Class 11 Warehouse

US Customs allows merchandise imported under bond to remain in its territory 15 days after it arrives at the port of destination. Shall the merchandise need to stay within the USA past it allotted time a General Order may be filled. Under

a G.O. the goods can stay in a bonded warehouse for up to 6 months from the day of importation.

If after 6 months the goods have not been documented or duties/fees paid, they will be sold at auction, donated to charity or retained by the Government.

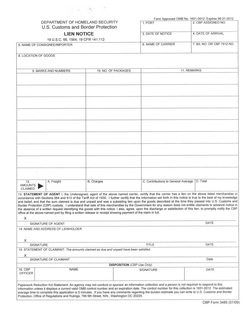

- Lien

The right to take and hold or sell the property of a debtor as security or payment for a debt or duty.

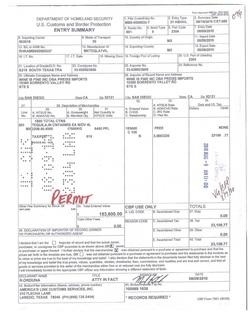

- Class 3 Warehouse

Bonded Merchandise can also be stored under a Warehouse Entry. These are several advantages of the Warehouse Entry over G.O. entry.

Goods entered under a Entry type 21 can remain in the bonded warehouse for up to 5 years from the date of importation. Another advantage of the warehouse entry is the ability to make partials withdrawals.

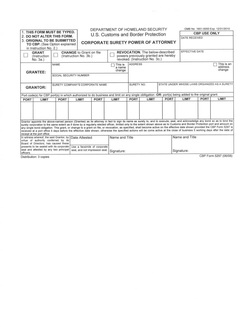

- Power of attorney

A legal instrument authorizing one act as another's attorney or agent.

Class 3 - Entry Type

Record the appropriate entry code by selecting the two-digit code for the type of entry summary being files. The first digit of the code identifies the general category of entry (i.e., consumption = 0, informal = 1, warehouse = 2). The second digit further defines the specific processing type within the entry category. The following codes shall be used:

Consumption Entries

Free and Dutiable 01

Quota/Visa 02

Antidumping/Countervailing Duty(AD/CVD) 03

Appraisement 04

Vessel Repair 05

Foreign Trade Zone Consumption 06

Quota/Visa and AD/CVD combinations 07

Duty Deferral 08

Informal Entries

Free and Dutiable 11

Quota other than textiles 12

Warehouse Entries

Warehouse 21

Re-Warehouse 22

Temporary Importation Bond 23

Trade Fair 24

Permanent Exhibition 25

Foreign Trade Zone Admission 26

Warehouse Withdrawal

For Consumption 31

Quota/Visa 32

AD/CVD 34

Quota/Visa and AD/CVD combinations 38

Government Entries

Defense Contract Management Command (DCMAO NY)

Military Only (P99 files) 51

Note:When the importer of record of emergency war materials in not

a government agency, entry type codes 01,02,03, etc., as appropriate,

are to be used

Transportation Entries

Immediate Transportation 61

Transportation and Exportation 62

Immediate Exportation 63

Automated Broker Interface (ABI) processing requires and ABI status indicator. This indicator must be recorded in the entry code block. It is to be shown for those entry summaries with ABI status only, and must be show in one of the following formats:

ABI/S = ABI statement paid by check or cash.

ABI/A = ABI statement paid via Automated Clearinghouse (ACH)

ABI/P = ABI statement paid on a periodic monthly basis

ABI/N = ABI summary not paid on a statement

Note: Either a slash (/) or hyphen (-) may be used to separate ABI from the indicator (i.e., ABI/S or ABI-S).

A "LIVE" entry is when the entry summary documentation is filed at the time of entry with estimated duties. Warehouse withdrawals are always considered "LIVE" entries. When a "LIVE" entry/entry summary is presented, an additional indicator is required to be shown in the following formats:

ABI/A/L = ABI statement paid via ACH for a "live" entry/entry summary

ABI/N/L = ABI "live" entry/entry summary not paid on statement

"LIVE" or "L" = non-ABI "live" entry/entry summary

Record the appropriate entry code by selecting the two-digit code for the type of entry summary being files. The first digit of the code identifies the general category of entry (i.e., consumption = 0, informal = 1, warehouse = 2). The second digit further defines the specific processing type within the entry category. The following codes shall be used:

Consumption Entries

Free and Dutiable 01

Quota/Visa 02

Antidumping/Countervailing Duty(AD/CVD) 03

Appraisement 04

Vessel Repair 05

Foreign Trade Zone Consumption 06

Quota/Visa and AD/CVD combinations 07

Duty Deferral 08

Informal Entries

Free and Dutiable 11

Quota other than textiles 12

Warehouse Entries

Warehouse 21

Re-Warehouse 22

Temporary Importation Bond 23

Trade Fair 24

Permanent Exhibition 25

Foreign Trade Zone Admission 26

Warehouse Withdrawal

For Consumption 31

Quota/Visa 32

AD/CVD 34

Quota/Visa and AD/CVD combinations 38

Government Entries

Defense Contract Management Command (DCMAO NY)

Military Only (P99 files) 51

Note:When the importer of record of emergency war materials in not

a government agency, entry type codes 01,02,03, etc., as appropriate,

are to be used

Transportation Entries

Immediate Transportation 61

Transportation and Exportation 62

Immediate Exportation 63

Automated Broker Interface (ABI) processing requires and ABI status indicator. This indicator must be recorded in the entry code block. It is to be shown for those entry summaries with ABI status only, and must be show in one of the following formats:

ABI/S = ABI statement paid by check or cash.

ABI/A = ABI statement paid via Automated Clearinghouse (ACH)

ABI/P = ABI statement paid on a periodic monthly basis

ABI/N = ABI summary not paid on a statement

Note: Either a slash (/) or hyphen (-) may be used to separate ABI from the indicator (i.e., ABI/S or ABI-S).

A "LIVE" entry is when the entry summary documentation is filed at the time of entry with estimated duties. Warehouse withdrawals are always considered "LIVE" entries. When a "LIVE" entry/entry summary is presented, an additional indicator is required to be shown in the following formats:

ABI/A/L = ABI statement paid via ACH for a "live" entry/entry summary

ABI/N/L = ABI "live" entry/entry summary not paid on statement

"LIVE" or "L" = non-ABI "live" entry/entry summary

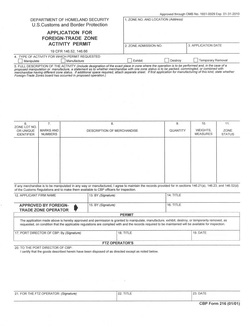

- FTZ

A foreign-trade zone is a designated location in the United States where companies can use special procedures that help encourage U.S. activity and value added – in competition with foreign alternatives – by allowing delayed or reduced duty payments on foreign merchandise, as well as other savings.

Benefits of Utilizing a Foreign Trade Zone

- Made in USA Label

- Ease of Paperwork & Quick Turnaround

- Storage

- International Returns

- Avoidance of Quota Restrictions

- Temporary Removal

- Tax Savings

- Avoid Fines & Penalties

- Export Savings

- Savings on Merchandise Processing Fees (MPFs)

- Direct delivery to your facility

- Not in U.S. Customs Territory

- Savings on consumed, unusable, or not in use materials

- Saving on Non-Material Expenses

- More choice on Duty Rates and Methods

- Under Customs Supervision

- Savings on Fees

- Saving on Machinery Duties

- Reduction on Federal Laws

- Ability to Adjust to Changing Laws

- Better Ability to Complete

- Saving on Distribution